by Judd Legum and Noel Sims,

There is a housing crisis in the United States.

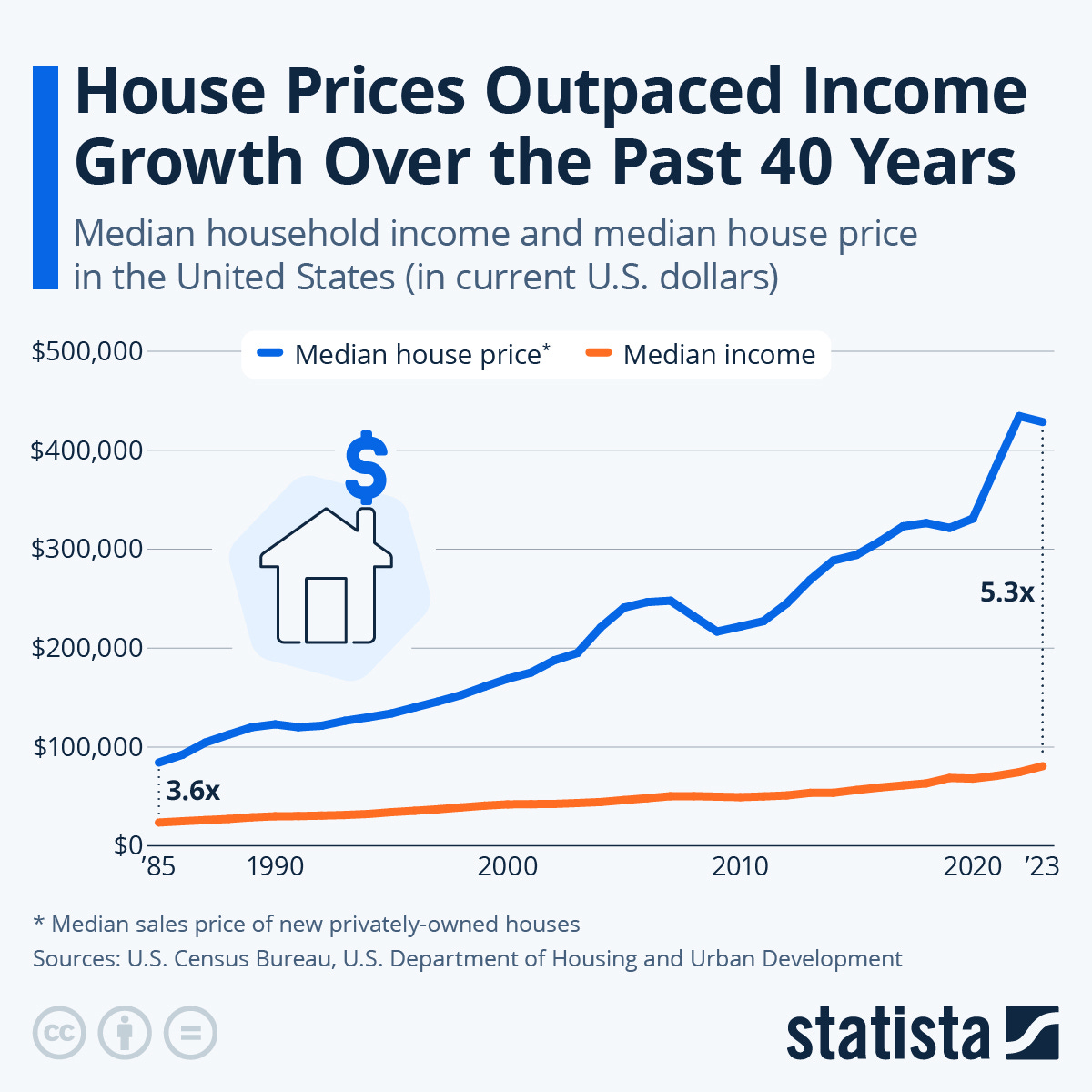

In 1985, the median income was $23,620, and the median price of a home was $84,300. So the typical house was 3.6 times the typical income. By 2023, the median price of a home was $428,600, which was 5.3 times the median income of $80,061.

In some metro areas, median home prices are more than eight times higher than the average income. In Los Angeles, San Francisco, and Honolulu, the price-to-income ratio exceeds 10. Home prices rose dramatically over the last five years, with the median cost of a single-family home increasing 48% between 2019 and 2024.

A severe shortage of homes is driving prices higher. A July 2025 analysis by Zillow found that “America’s housing shortage grew to an all-time high of 4.7 million units.”

According to Bankrate’s 2025 Housing Affordability Study, Americans need an income of about $117,000 to afford an average home. In 2020, the income needed to afford an average home was $78,000. Those figures reflect the increasing price of homes and higher interest rates.

Over the weekend, President Trump teased a new policy on social media to address the issue: a 50-year mortgage.

Bill Pulte, Director of the Federal Housing Finance Agency (FHFA), confirmed that this was a real proposal. “Thanks to President Trump, we are indeed working on The 50 year Mortgage — a complete game changer,” Pulte wrote on X.

But while the introduction of a 50-year mortgage would be a windfall to the financial industry, it would do little to make housing more affordable and saddle a generation of Americans with a lifetime of debt.

Similar monthly payments, massive interest

The idea of a 50-year mortgage is that by spreading the cost of a home over 20 more years, you can reduce the monthly mortgage payment. But in practice, those savings are modest.

First, just as a 30-year mortgage has a higher interest rate than a 15-year mortgage, a 50-year mortgage will have a higher interest rate than a 30-year mortgage. Experts estimate that a 50-year mortgage would be about .5 points higher than a 30-year mortgage. Since the current 30-year mortgage rate is about 6.3%, a 50-year mortgage would have an interest rate of 6.8%.

So homebuyers using a 50-year mortgage would pay a higher interest rate over a much longer time period. This limits the reduction in the monthly payment.

HousingWire, using the Fannie Mae mortgage calculator, found that for a typical home costing $400,000, the monthly payment for a 30-year mortgage would be $2,481. The monthly payment for the same home with a 50-year mortgage would be $2,346 — a savings of just $135 per month. (That does not account for sellers potentially raising their prices once a 50-year mortgage becomes available.)

Meanwhile, over the course of the 50-year mortgage, the buyer of a $400,000 home will have paid over $1 million in interest, compared to $493,000 in interest payments for a 30-year mortgage. The big winner here is the lender, not the home buyer.

The equity trap

Many Americans are interested in buying a home because it is seen as an effective way to build wealth. Homeowners grow their wealth through establishing equity over time. But with a 50-year mortgage, the process of building equity is much slower.

Considering the same $400,000 home, with a 30-year mortgage and a 6.3% interest rate, it would take about nine years to pay off the first $50,000 in principal. For the 50-year mortgage with a 6.8% interest rate, paying off the first $50,000 in principal would take about 24 years.

The difficulty in acquiring home equity makes these loans riskier for owners. Since the owner will have little equity in the home for many years, any downturn in the housing market could put the home “underwater.” That means the owner has “negative equity” because the home is worth less than the outstanding mortgage. This makes it virtually impossible for homeowners to relocate or address a financial emergency through a home equity line of credit.

The influencer guiding Trump’s housing policy

The 50-year mortgage proposal was developed by Pulte, who was directed by Trump to use his position to lower housing costs. But Pulte is not an expert in housing policy.

Pulte previously founded an investment firm but is best known for amassing a large following on X as an online philanthropist, giving away money in a series of viral stunts. He is the grandson and heir of William Pulte, who founded home-building giant PulteGroup. After his grandfather died, Pulte’s relationship with the company and many members of his family soured. Pulte sued the family company, accusing his grandfather’s widow of insider trading.

As director of the FHFA, Pulte made the obscure agency a major player in Trump’s political battles. The FHFA’s primary responsibilities are to regulate the mortgage market and oversee Fannie Mae and Freddie Mac. Pulte, however, has used his position to accuse Senator Adam Schiff (D-CA) and New York Attorney General Letitia James (D) of mortgage fraud.

Pulte has also repeatedly criticized Federal Reserve Chairman Jerome Powell and urged Trump to fire him. This has led to a rift with Treasury Secretary Scott Bessent, who supports Powell. During a private dinner with other administration officials, Bessent reportedly threatened to punch Pulte “in the fucking face.”

In October, Pulte fired dozens of Fannie Mae employees. While he claimed that the firings were to end DEI efforts within the company, the Washington Post reported that Pulte had gutted the company’s internal watchdogs after they began investigating one of his close allies.

Source: https://popular.info

Disclaimer: We at Prepare for Change (PFC) bring you information that is not offered by the mainstream news, and therefore may seem controversial. The opinions, views, statements, and/or information we present are not necessarily promoted, endorsed, espoused, or agreed to by Prepare for Change, its leadership Council, members, those who work with PFC, or those who read its content. However, they are hopefully provocative. Please use discernment! Use logical thinking, your own intuition and your own connection with Source, Spirit and Natural Laws to help you determine what is true and what is not. By sharing information and seeding dialogue, it is our goal to raise consciousness and awareness of higher truths to free us from enslavement of the matrix in this material realm.

EN

EN FR

FR