By Tyler Durden,

Submitted by a former JPMorgan economist who wishes to remain anonymous

The everything bubble

Readers will have anticipated the bursting of the bubble that has been re-inflating ever since 2009. Ultra-loose monetary policy, coupled with deflationary pressures from increased aggregate supply and investors chasing yield at ever higher risk, meant that almost all asset classes had reached all time highs just before entering the current bear market.

That there is a bubble, a massive one, is unquestionable. Readers will further have anticipated that it didn’t have to be a global pandemic to burst this bubble. This bubble was practically looking for a prick – any prick – to burst it. Whether it was a credit event, liquidity shortages that led to bankruptcies, a terrorist attack, a natural disaster or a bat: markets had reached a level of fragility where they could not cope with the materialising of such a tail risk event.

📊 WATCH: Two Decades Of Growing Global Debt 📊

In 2020, a sharp upward trajectory in debt levels looks all but certain. More in the latest IIF Global Debt Monitor: https://t.co/Exj7rDDPpx pic.twitter.com/q0R1vi05DY

— IIF (@IIF) April 14, 2020

Market outlook

Expect companies in energy to go bust first. Then retail and hospitality. At some stage their bankruptcies will push creditors into a corner where such lenders will either have to be bailed out or they will drop like flies (Lehman style). Already banks have slowed their credit lines to corporates, like in 2008/2009, anticipating that some of their debtors will fail to repay.

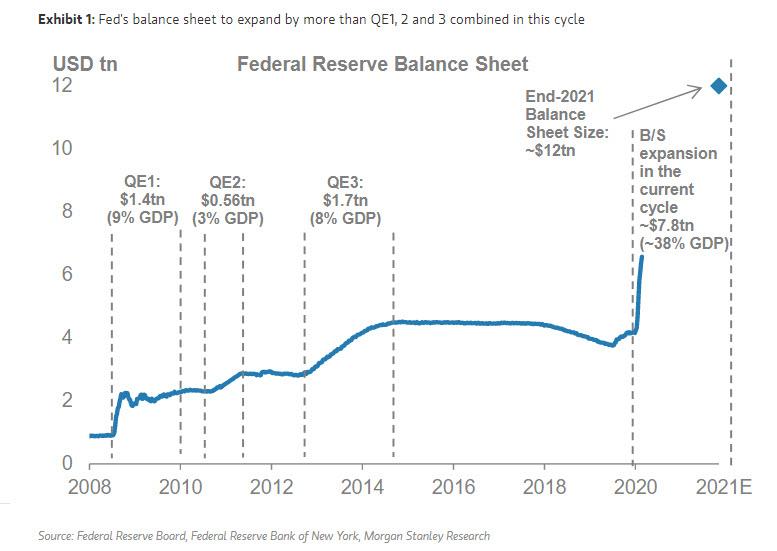

Sure, with more QE flooding the markets a complete wipe-out may be averted, as there is no political appetite for mass insolvencies (especially in an election year in the US).

The bubble has reached a level where systemically relevant banks will be facing their Lehman moment sooner rather than later. Lawmakers will not allow such systemically relevant lenders to go under, as this would practically imply all lights to go out. So the real question at hand is: at what cost?

- At what cost to prevent the Deutsche Banks of this world from going bankrupt?

- At what cost to keep the unemployed at bay, because for sure: no job, no income and no prospects are a recipe for turmoil and civil unrest.

- At what cost to counter big institutional sellers exiting the markets who want cash?

- At what cost running the biggest budget deficit and current account deficit (in the US)?

- At what cost managing the havoc from Covid-19?

- At what cost QE forever?

- At what cost etc.

Crossing the Rubicon

On April 27, 2020 CNBC ran a story on “Why the coronavirus crisis may prompt central bankers to scrap inflation targeting”.

If central banks indeed abandon or modify inflation targeting we will certainly be crossing the Rubicon. Admittedly, there is no other way in answering the above questions.

Policymakers continue to be behind the curve and obviously failed to learn from 2008/2009. Their last resort is printing money and creating more debt. If central banks have no or a soft-washed inflation mandate we are heading towards a Weimar Republic style inflation setup.

With global output staying the same or declining, aggregate demand declining significantly and the quantity of money in circulation multiplying (by means of handouts or universal basic incomes), asset prices across asset classes being propped up by central banks, it becomes just a matter of time until inflation goes from ‘subdued’ to ‘out of hand’.

Asset allocation in this new set up

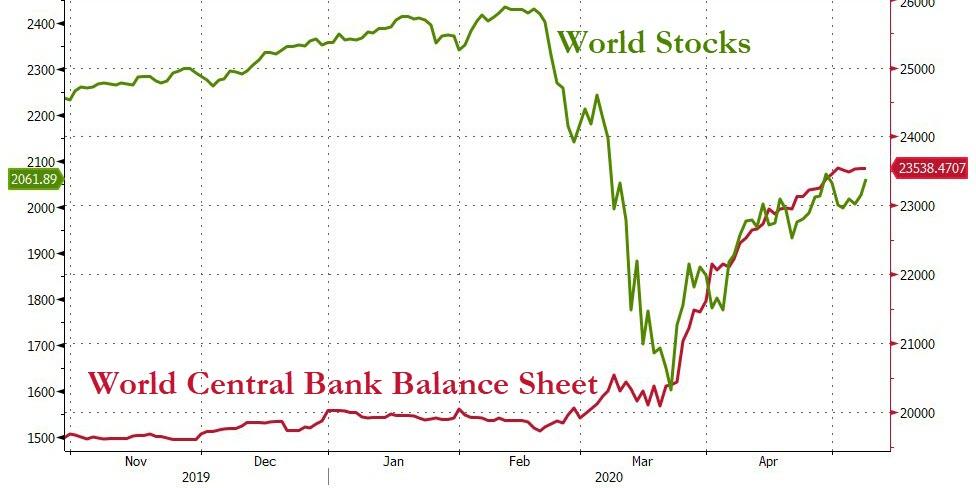

With central banks either purchasing corporate bonds or accepting them as collateral, it may be soon until their mandate is being changed to facilitate the buying of equities, too. As other commentators already noted: we may have abandoned free markets and now head to a centrally planned set up.

The recent pick-up from the March 2020 lows in stock markets will be short lived. Nothing has fundamentally improved, other than emergency liquidity provisions by central banks. Expect a new selloff by year end – re-testing the lows of March – because perfidiously the Fed does not yet own enough corporate debt/equity to control asset prices!

Central banks will be printing fiat money on a unprecedented scale. With potentially negative interest rates even in the US, a slowing of global trade and thus reduced supply, the risk of a surprise inflation increases markedly. If and when this feeds through, asset allocation becomes key.

Look for uncorrelated asset classes or inflation resistant assets. There is a chance central banks will own a good part of cross-sector corporate debt/equity when the dust settles and inflation starts to go through the roof.

Source: https://www.zerohedge.com

Disclaimer: We at Prepare for Change (PFC) bring you information that is not offered by the mainstream news, and therefore may seem controversial. The opinions, views, statements, and/or information we present are not necessarily promoted, endorsed, espoused, or agreed to by Prepare for Change, its leadership Council, members, those who work with PFC, or those who read its content. However, they are hopefully provocative. Please use discernment! Use logical thinking, your own intuition and your own connection with Source, Spirit and Natural Laws to help you determine what is true and what is not. By sharing information and seeding dialogue, it is our goal to raise consciousness and awareness of higher truths to free us from enslavement of the matrix in this material realm.

EN

EN FR

FR