By Chelsey Taylor,

Being a sole proprietor, self-employed, or an independent contractor can feel five times as hard sometimes. Just look at the Paycheck Protection Program (PPP) and its promise of loan forgiveness for small businesses. How does it even work if you’re on your own?

I’m still trying to figure out how to apply for forgiveness.

Roger Kaufman, who runs a masonry company in New York, told us. And we get it—there’s so much confusion around the process, rules, and even the words that describe it. In fact, some of you didn’t apply for a PPP loan because you weren’t sure it could be forgiven.

That’s what we’re here for.

We created a comprehensive, comprehensible guide all about PPP loan forgiveness for the self-employed, sole proprietors, and independent contractors. This is everything we know based on information directly from the SBA and the 19th Interim Final Rule (IFR) filed on June 19th, 2020.

Below, you’ll find:

- PPP loan forgiveness requirements for solos

- How to calculate your loan forgiveness

- How to apply for PPP loan forgiveness: Step-by-step instructions on filling out the application form 3508EZ, examples, and video tutorial

- A complete list of documents you need to apply

- Tools and resources including the new SBA PPP forgiveness platform and forgiveness FAQs updated on 8/11/20

While the PPP’s forgiveness portal opened up this week, most financial advisors suggest waiting to submit applications until Congress decides what will happen next. This guide contains helpful information for filling out the application as of 8/14/20. We’ll update it to reflect changes in forgiveness as they occur.

How Does PPP Loan Forgiveness Work for the Self-Employed?

Is this loan really forgivable?

Willette Watts, a realtor in Tulsa, OK, asked in one of our discussions on the PPP. And she wasn’t the only one—this question came up again and again.

So let’s clear the air.

According to the Paycheck Protection Program Flexibility Act, freelancers, self-employed individuals, solopreneurs, and independent contractors who took their maximum loan amount (2.5x their 2019 monthly income) are ensured full forgiveness.

In short, if you took out a PPP Loan as a self-employed individual with no employees, you can absolutely have your loan forgiven—here’s how to know if you qualify.

You must have been harmed by the pandemic and meet three requirements:

- You filed or will file a Form 1040 Schedule C for 2019, showing self-employment income.

- You were in operation on February 15, 2020

- The United States is your primary place of residence.

As a reminder, some of the terms of the PPP loans changed with the Flexibility Act. Here’s what you need to know.

- Received a loan after June 5th? The maturity date of the loan is now five years. I.e., you have five years after the loan date to pay whatever parts can’t be forgiven back.

- Received a loan before June 5th? The original term was two years, but you might be able to extend it to five by working with your lender.

- You now have 24 weeks to use the loan to qualify for forgiveness. Before the Flexibility Act, it was eight.

- To ensure that your whole loan can be completely forgiven, you must spend 60% of it on payroll. The less you use for payroll, the less will be forgiven.

Related: What You Need to Know About the Flexibility Act

You might be wondering, how can you use the loan on payroll if you don’t have any employees? Don’t forget yourself—you’re an employee of your business after all.

Here’s what you can use your PPP loan for:

- To pay your own compensation/salary (based on the calculation outlined below).

- To cover non-payroll expenses (incurred or paid) through February 15, 2020. This includes:

- mortgage + interest payments

- rent (business rent or lease payments)

- utilities (electricity, gas, water, and transportation),

- debt interest payments

There are some changes depending on when you received your loan, so you’ll need to do some research to find out what you qualify for. Wherever possible, please source the SBA directly.

How to Calculate PPP Loan Forgiveness if You’re Self-Employed

Okay, so you’ve qualified for a PPP loan and forgiveness based on the outline we provided above. Now, you need to figure out how much money you can receive. Thankfully, it’s simple.

To calculate your maximum loan and forgiveness amount, follow these four simple steps.

- Step 1: Fill out your 2019 IRS Form 1040 Schedule C (if you haven’t already).

- Step 2: Take the amount from Line 31 (Net Profit or Loss). If it is more than $100,000, use $100,000.

- Step 3: Divide the amount from Step 2 by 12.

- Step 4: Multiply the result of Step 3 by 2.5.

Now you have your maximum PPP forgiveness amount—up to $20,833.

Under the PPP Flexibility Act, you can also calculate your maximum loan based on eight weeks of compensation up to $15,385. All you have to do is divide your 2019 net profit by 52 and then multiply by eight.

If you need help figuring out your maximum loan forgiveness amount, there are plenty of tools available.

- Try this PPP loan forgiveness calculator from Intuit called AidAssist.

- Or reach out to your accountant or banker if you have more questions about this step.

Do You Qualify for the EZ Loan Forgiveness Application?

Now, it’s time to get into the heart of PPP loan forgiveness: filling out the application form. We’ve put together step-by-step instructions that you can follow to avoid common mistakes.

Thankfully, it’s not as hard as you think. If you’re a sole proprietor and don’t have any employees, you don’t have to fill out the full-loan application. Instead you get to use the EZ Application, which is only two pages long.

Not only does this save you pages of information, but it also means you have to complete fewer calculations and provide less documentation.

To find out if you qualify for the EZ Application, take a look at the below questions. If you answer “yes” to the first question or “no” to the second, you’re in luck.

- Are you self-employed, an independent contractor, or sole proprietor with no employees?

- Did you reduce the salaries or wages of your employees by more than 25% and reduce the number or hours of your employees?

When responding to the second question, make sure one of the following applies:

- You didn’t reduce the number of employees you had or their average paid hours between January 1, 2020 and the end of the Covered Period.

If you do have employees, any decreases in staff can affect your loan forgiveness. The CARES Act considers “full-time equivalent employees” when determining how much to reduce your loan forgiveness by if your staff count went down. To figure this out for each employee:

- Calculate the average number of hours you pay an employee each week

- Divide that by 40

- Round the total to the nearest tenth

The max number for each employee is 1.0. An even simpler way to do this? Assign 1.0 for 40-hour per week employees and 0.5 for anyone who works less than that.

Here are two situations that you can ignore staff reductions or reduced hours:

- If you couldn’t rehire individuals who were employed on February 15, 2020 because you were unable to find similarly qualified employees for open positions on or before December 31, 2020.

- If you offered to restore your employees’ full hours and they refused.

OR

You couldn’t operate your business at the same level during the Covered Period as before February 15, 2020 because you were complying with requirements or guidance from the CDC, Secretary of Health and Human Services, or Occupational Safety and Health Administration (OSHA) issued between March 1, 2020 and December 31, 2020.

These requirements include sanitation, social distancing, or other work/customer safety issues relating to coronavirus

How to Fill Out the PPP Loan Forgiveness Application Form

Now, let’s get to it and break down the 3508EZ form into manageable chunks that you can fill out.

You can also find directions directly from the SBA here.

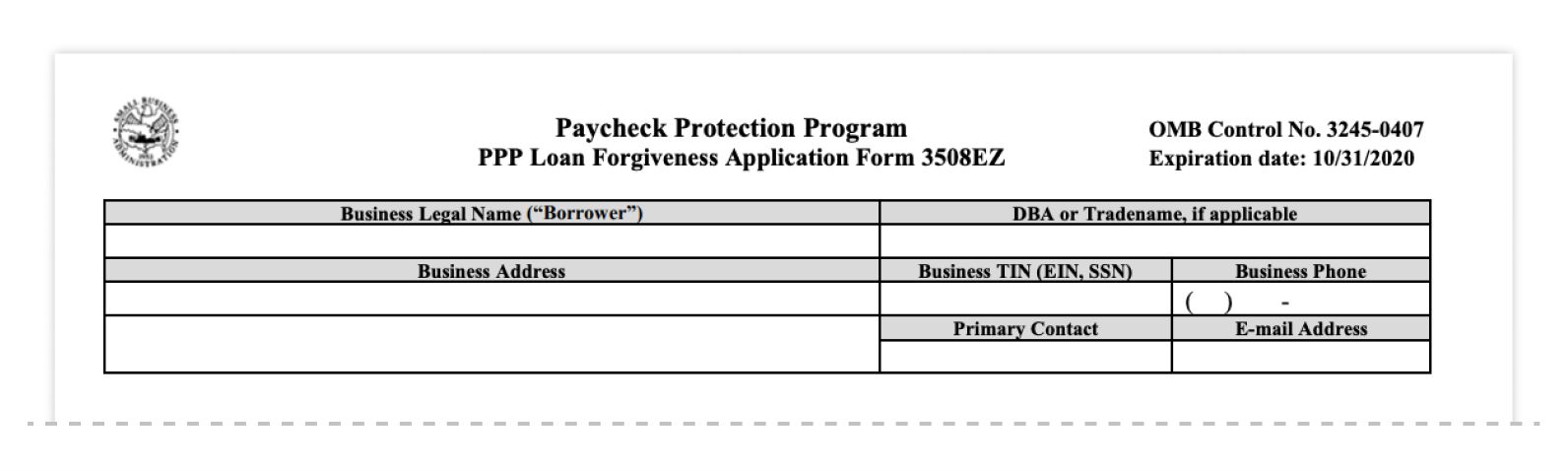

Step 1: Fill out your business information

The first step is to fill out your identifying information. This is how the government will legally review your business and should match what is already on file.

Let’s go through each of these sections.

- Business Legal Name (“Borrower”): This business name should match the name on your tax returns and your original loan form.

- DBA or Tradename, if applicable: Only provide a DBA (doing business as) if the business name that appears on your supporting documents is different from your legal name.

- Business Address, Business TIN (EIN, SSN), Business Phone, Primary Contact, and Email Address: All of this information should match your tax returns or original PPP application (if you are reapplying).

Step 2: Give the details of your PPP loan

Next, you need to fill out your PPP loan information. This is fairly self-explanatory, but just in case, we’ll go through it all.

- SBA PPP Loan Number: This is the SBA-assigned number provided to you at the time of loan approval. If you don’t have this number, talk to your lender.

- Lender PPP Loan Number: Ask your lender for the number they assigned to the PPP loan.

- PPP Loan Amount: This should be the total loan amount you received from the Lender.

- PPP Loan Disbursement Date: This is the date you received your loan funds and will start your 24-week countdown.

- Employees at Time of Loan Application: When you first applied for your PPP loan, how many employees did you have?

- Employees at Time of Forgiveness Application: While filling out the EZ forgiveness application, how many employees do you have?

- EIDL Advance Amount: If you received an advance or grant, you’ll need to record it here and understand that this amount will be deducted from your forgiveness amount.

- EIDL Application Number: If you applied for an EIDL loan, which is different from the grant, put that application number here. The SBA Disaster Assistance hotline might be able to help if you don’t know yours or check with your lender.

Step 3: Provide your payroll information

This is a fairly simple step. Even if you are self-employed, an independent contractor, or a sole proprietor, you’ll need to provide this information. Just refer to your owner, contractor, or freelance compensation.

- Payroll Schedule: During the period covered by the loan (either eight or 24 weeks, depending on when you received it), check the box that best matches when you were paid.

- Covered Period: PPP Loans prior to June 5th, 2020, cover an eight-week forgiveness period. Loans disbursed after June 5th, 2020, have a 24-week covered period. The first date should be the date of loan disbursement and then count eight or 24 weeks from there for the second date.

- Alternative Payroll Covered Period: If you run a weekly or biweekly payroll, you can start your covered period on the day of your first pay period.

Step 4: Calculate your forgiveness amount

This is the section of the application that worries most people. How do you calculate your loan forgiveness amount? We already walked you through the most difficult four steps when we talked about your maximum loan amount, above. You’ll use that information here.

For individuals with no employees and who did not run payroll in 2020, this section is actually fairly easy. It will take a little math, but it’s straightforward. We’ve even included some examples to show you what it could look like.

- Line 1: This is the loan forgiveness amount you calculated above (your salary divided by 12 and multiplied by 2.5). This value maxes out at $20,833.33.

- Lines 2–4: These lines reveal your applicable interest payments “incurred or paid” during the covered period (eight or 24 weeks).

- Line 5: The sum of lines 1, 2, 3, and 4.

- Line 6: The total actual PPP loan amount you received.

- Line 7: Divide line 1 by .60 and enter that number.

- Line 8: Between lines 5, 6, and 7, enter the smallest number here. This is the actual PPP Forgiveness amount.

Want to see this in real life? Here are some examples.

Example 1: Here are application numbers for a freelancer who received the max loan amount of $20,833 based on hitting the $100,000 threshold. She has no employees, does not rent an office, and only pays for a separate work phone.

- Line 1 (Payroll Costs): $20,833.33

- Line 2 (Mortgage Interest): $0

- Line 3 (Rent/Lease Payments): $0

- Line 4 (Utility Payments): $150

- Line 5 (Add Lines 1 – 4): $20,983

- Line 6 (Loan Amount): $20,833

- Line 7 (60% Payroll Cost Requirement): $34,721

- Line 8 (Forgiveness Amount): $20,833

Example 2: Here’s another example from a solopreneur who earned less. He had a total payroll of $68,000, but he also had lease payments of $3,600 and some utilities totaling $200. He got a loan for $18,250.

- Line 1 (Payroll Costs): $14,166.66

- Line 2 (Mortgage Interest): $0

- Line 3 (Rent/Lease Payments): $3,600

- Line 4 (Utility Payments): $200

- Line 5 (Add Lines 1 – 4): $17,966.66

- Line 6 (Loan Amount): $18,250

- Line 7 (60% Payroll Cost Requirement): $23,610

- Line 8 (Forgiveness Amount): $17,966.66

In this case, the loan the solopreneur received was slightly higher than what is eligible for loan forgiveness, so he will need to pay back $284.

For more PPP loan forgiveness guidance, check out the SBA’s FAQ. Or talk with an accountant suggests Mitchell Nelson a Senior Care Specialist.

There are many unanswered questions about the PPP and the best person to ask this question is your CPA.

You can also check in with your banker, recommends Herbert Gottlieb from Gottlieb and Associates.

If you have a good relationship with your bank and a banker, they will be happy to assist.

Step 5: Certify your loan forgiveness application

Next, you just need to certify that you have filled out the one-page form correctly and truthfully. Read through each section and initial next to each statement.

Make sure to be honest here. If you’re not and make a false statement to get more of your loan forgiven, you could face consequences like fines and even imprisonment. If you have any questions about this section, talk with your accountant or banker.

Step 6: Demonstrate your forgiveness eligibility

Now, initial next to at least one of these explanations to show that you’re eligible for forgiveness. If both apply to your business, initial next to both items.

Step 7: Don’t forget to sign!

Finally, sign and date your application.

Prefer a video walkthrough? Watch the below video for step-by-step instructions to fill out the EZ forgiveness application if you’re self-employed and have no employees.

Documents to Include with Your PPP Loan Forgiveness Application Form

Wait! You’re not done yet.

Before you can submit your completed 3508EZ form, there are a few documents you’ll need to include.

Payroll documentation

You need to verify your eligible payroll and any non-cash benefit payments during the covered period (8 or 24 weeks). This includes:

- Bank Account Statements: Reports showing the amount of compensation paid to employees or to yourself.

- Tax Forms: Tax filings that overlap the covered period.

- Payroll tax filings reported to the IRS (Form 941).

- State quarterly business and individual employee wage reporting and unemployment insurance tax filings.

- Employer Contributions to Group Employee Benefit Plans: Receipts for payments, cancelled checks, or bank account statements showing how much you paid toward health insurance, retirement, or other benefits.

If you have employees, you are also required to report the average number of full-time equivalent employees on payroll on January 1, 2020, and at the end of the covered period.

Non-Payroll Documentation

You will also need to provide documentation that verifies your eligible interest, lease, and utility payments during the covered period.

- Business Mortgage Interest Payments: Copy of lender authorization and receipts or cancelled checks.

- Business Rent of Lease Payments: Current lease agreements and receipts verifying payments.

- Business Utility Payments: Copy of invoices and receipts verifying payments.

If you need help gathering any of your documentation, Karin B. Orlowski from Concierge Wealth Management Service suggests going to your bank.

Your bank has a list of documentation needed to complete the application and will certify and forward the paperwork to the SBA.

PPP Loan Forgiveness Tools and Resources to Help

If you need additional help obtaining forgiveness, don’t worry; you’re not alone. There are many resources and tools from the SBA and beyond. Check them out:

- For more answers to common forgiveness questions, go to the SBA’s FAQs on loan forgiveness effective 8/11/20

- The SBA launched their PPP forgiveness platform, which is accepting applications now.

- If you received money from the SBA, tracking it can help ensure forgiveness. Here’s exactly how to do it, according to the Massachusetts Small Business Development Center (MSBDC)

Watch: Track your SBA money - For guidance on how to get through the pandemic as a small business owner, check out MSBDC’s pre-recorded covid webinars and Youtube channel

- For information, tips, and opportunities for the self-employed, head over to the SBA’s Self-Employed Category

- For freelancers, take a look at the Coronavirus Resources from the Freelancers Union

- Find an approved SBA PPP lender in your state

We hope this helps you get maximum forgiveness for your PPP loan. Let us know what questions you have, and we’ll do our best to answer them. You can always ask a question on the platform for advice from our community members, too.

Remember, we’re all in this together, so let’s lean on each other and share tips to make this process easier. After all, that’s what this community is here for.

Are you self-employed? Have you applied for PPP loan forgiveness? Tell us what your experience has been like to help others through the process.

For more on helping your business recover, check out the below articles:

- How to Ramp Up Your Online Sales for Your Business

- Top 5 Benefits of Online Networking

- How to Set up a Social Media Strategy and Expand Word of Mouth

- My Money Stays Local: How to Help Your Business & Community Recover

Disclaimer: The information contained in this document is for general information purposes only. The Massachusetts District Office does not make any representations, warranties, or guaranties, express or implied, as to the accuracy or completeness of the information contained within. Any opinions provided herein are not the official opinions of the SBA, are not binding on the SBA, and shall not be considered eligibility or forgiveness determinations for any of SBA’s loan programs. Additionally, information changes frequently so this document may not reflect the most current information. The information is strictly intended to be helpful when navigating PPP Forgiveness.

Special thanks to writer Kelly Vo and the SBA for their help in putting this guide together.

Disclaimer: We at Prepare for Change (PFC) bring you information that is not offered by the mainstream news, and therefore may seem controversial. The opinions, views, statements, and/or information we present are not necessarily promoted, endorsed, espoused, or agreed to by Prepare for Change, its leadership Council, members, those who work with PFC, or those who read its content. However, they are hopefully provocative. Please use discernment! Use logical thinking, your own intuition and your own connection with Source, Spirit and Natural Laws to help you determine what is true and what is not. By sharing information and seeding dialogue, it is our goal to raise consciousness and awareness of higher truths to free us from enslavement of the matrix in this material realm.

EN

EN FR

FR

I’ve been exploring for a little for any high-quality

articles or weblog posts on this kind of space . Exploring in Yahoo I ultimately stumbled upon this web site.

Reading this info So i am happy to exhibit that I’ve a

very just right uncanny feeling I discovered just what

I needed. I so much certainly will make sure to do not forget this site and

give it a glance regularly.

I have one question that I haven’t had answered anywhere that I’ve looked. Despite having several quite lean months, I ended up making roughly the same in 2020 as I did in 2019. When the $10000 PPP loan is counted in my total income for 2020 it will show me making more than I did in 2019. Will that make me ineligible for loan forgiveness?

Would be nice to have an expert available to walk me through this EZ application for full forgiveness. Not so easy for me!

Does Audible Function?

First, you take a trial of Audible and receive a free audiobook.

This really is among even an originals or the classics.

At the conclusion of your trial, you can buy a monthly subscription of Audible.

You have to register for the membership with your Amazon account.

Audible awards , Monthly. You can use this credit to buy Audible audio books in different categories such as technology, fashion, romance, social networking,

advertisements, etc..

You can buy Audible credits or pay per audio publication if you want to buy books.

Lately, a member can download two of six Audible Originals about the first Friday of every month.

They do not cost any credits. These Audible Originals can be kept by you .

You own all Audible books in your library even in the event that you

cancel your subscription.

It’s possible to listen to Audible books anyplace using apps for Windows, your mobile

or Mac computer or Alexa apparatus.|

With over 300,000 titles to its title, Audible is the world’s

biggest vendor and producer of audiobooks. https://luckyflirt.com/blogs_post.php?id=28625