By

Adulting, the now common idiom goes, is hard. And to many millennials, the grim realization that debt will always be part of their lives is not making it any easier.

In some cases, their debt load is so soul-crushing they expect to die without ever paying what they owe back. So how much does this problem have to do with the higher-education crisis the country is facing? As it turns out, everything.

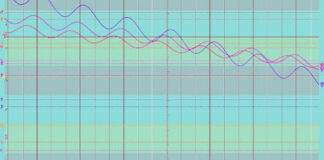

According to a study by Northwestern Mutual, educational loans are the leading source of debt for millennials ages 18 to 24. And according to a CreditCards.com report, over 60 percent of millennials aged 18 to 37 are completely unsure when, or if, they will be able to pay their debt off. Among those who responded they are uncertain about their ability to pay off debt, 20 percent said they expected to die in debt.

But to those with only credit card debt, the prospects aren’t as grim, as 79 percent of millennials said they had a plan to pay it all off, expecting to be completely debt-free by age 43.

While many of the news outlets reporting on these findings urge young people to get a plan in place so they can pay off their debt, the reality is that government’s push to give everyone a college education is what has greatly contributed to young people’s debt load. And what’s worse, degreesare not actually helping many young people get a job.

Will bureaucrats and those who pushed for more government-subsidized education ever admit they created a monster that has finally gotten out of control?

Government’s Role in Millennials’ Bad Choices

When government and elected officials push college education as a right, they imply that the government has the duty to help provide it to the populace. With grants, subsidies, and easy, risk-free loans going out to 17-year-olds with no credit history, young people think pursuing the career of their dreams is a piece of cake. But once school is out and all they have is a diploma, they finally realize things weren’t as easy as they expected.

The problem is that when government enters the picture and makes it easier for consumers to pay for college, it artificially increases the demand for college. With a greater number of students demanding higher education, schools have to raise their prices. After all, they have a limited supply of what they offer.

As explained by economist Ryan McMaken, “Were it not for the subsidized loans and — in the case of public colleges — directly subsidized tuition, the number of students able to afford such degrees would shrink considerably.” With fewer students knocking on their doors, colleges would have to slash costs and, consequently, prices, just so they could fill up their empty classrooms. But to bureaucrats, the solution doesn’t lie with letting the market work. Instead, they want more government interference.

Pushing for better loan deals, more regulation, or penalties for students who can’t pay the loans back, bureaucrats and their supporters are only worsening the problem they created.

In an age in which more and more employers are ditching degree requirements, paying for a piece of paper proving you finished college is becoming increasingly unnecessary. The governmentcontinues to head in the wrong direction, giving young people the idea that college is for everyone. If this doesn’t prove the government doesn’t have our best interests at heart, nothing else does.

Chloe Anagnos

Chloe Anagnos is AIER’s Publications Manager. She is a writer and digital marketer and has been an AIER contributor since 2017. Her work has been the subject of articles in FOX News, USA Today, CNN Money, and WIRED. She has been a writer, commentator, and panelist for media outlets around the country on subjects like political marketing, campaigning, and social media. Follow @ChloeAnagnos.

Disclaimer: We at Prepare for Change (PFC) bring you information that is not offered by the mainstream news, and therefore may seem controversial. The opinions, views, statements, and/or information we present are not necessarily promoted, endorsed, espoused, or agreed to by Prepare for Change, its leadership Council, members, those who work with PFC, or those who read its content. However, they are hopefully provocative. Please use discernment! Use logical thinking, your own intuition and your own connection with Source, Spirit and Natural Laws to help you determine what is true and what is not. By sharing information and seeding dialogue, it is our goal to raise consciousness and awareness of higher truths to free us from enslavement of the matrix in this material realm.

EN

EN FR

FR

Thanks for sharing a information.It is really informative post.Valuable information provided Merchant Cash Advance is a short-term funding solution that is mostly availed to develop a business so that it can generate revenue. In most cases, a cash advance is taken by the merchant in lien of selling a small future business receivable to the lender.

As always, follow the money. Although the government probably does want to encourage higher education, the real bad actors here are the for-profit institutions and lenders who have lobbied our legislators to get the system to its present state. Putting my free market tendencies aside for a moment, it isn’t right to let an 18-year old enter into a six-figure borrowing transaction with no risk to the lender (i.e. default).

Adults who signed up for Trump University – I can only say shame on both sides.

I have a friend who began her career after raising her family with student loans. She is 67 and still over one hundred thousand in debt from it and her job pays very well I might add. This is a travesty. Do any of you know any student loan debt relief programs that actually help? Any idea would be followed up on!