- The Great Recession has been over for a decade.

- Yet many people’s finances haven’t recovered from the recession’s blows, according to a new survey by personal finance website Bankrate.com.

- “Even a modest downturn is going to cause further harm to Americans personal finances,” said Mark Hamrick, senior economic analyst at Bankrate.com.

By Annie Nova,

The Great Recession has officially been over for a decade. For many Americans, there’s little reason to celebrate.

Many people’s finances haven’t recovered from the recession’s blows, according to a new survey by personal finance website Bankrate.com.

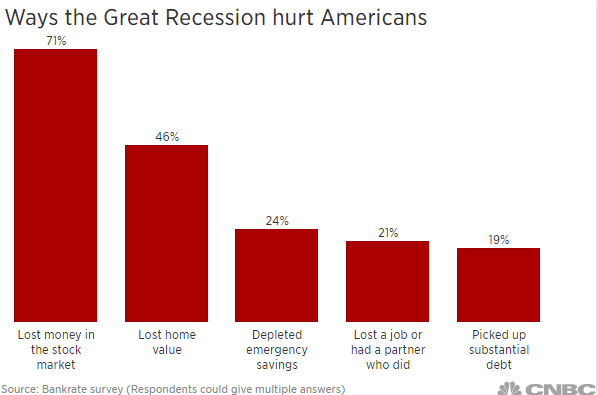

More than half of Americans who were adults amid the Great Recession said they endured some type of negative financial impact, Bankrate found. And half of those people say they’re doing worse now than before the crisis.

Fewer than half (46%) of those who were adults at the time of the recession say they’ve seen their paychecks grow since before it began. More than a third of those who say they, or their partner, lost a job during the recession say their pay has actually dropped from before the recession. More than 2,700 adults were interviewed online in May.

The median family income, after accounting for inflation, was $59,039 in 2016, little different than it was in 2000 ($58,544). During the same time, medical, childcare and college costs have ballooned.

To be sure, the economy has bounced back from when the unemployment rate spiked at 10% in 2009 and more than 15 million Americans were out of work. Today the unemployment rate is 3.6%. Gross domestic product, the broadest measure of goods and services produced in the U.S., rose at a 2.6% annual rate in the fourth quarter of 2018. During the recession, it fell 4.3%, the largest decline since World War II.

Yet, Hamrick said, “It’s not like you can import that data into your personal experiences.”

“Surveys like this help to provide the detail and the colors of the economy, which remind us that individual results vary,” he said.

How much people have recovered from the crisis, he said, has a lot to do with where they live, the sector in which they work and how damaged they were by the recession. Gender also plays a role.

Twenty-seven percent of women say their overall financial situation is worse today than before the recession, compared to 19% of men.

“Women face bias in the workplace and that exhibits itself in the pay and opportunities for advancement that they’re given,” Hamrick said.

He said the next economic slump, whenever it occurs, could be particularly damaging. “Many Americans are still digging out from the recession,” he said. “Even a modest downturn is going to cause further harm to Americans’ personal finances.”

Source: https://www.cnbc.com

Disclaimer: We at Prepare for Change (PFC) bring you information that is not offered by the mainstream news, and therefore may seem controversial. The opinions, views, statements, and/or information we present are not necessarily promoted, endorsed, espoused, or agreed to by Prepare for Change, its leadership Council, members, those who work with PFC, or those who read its content. However, they are hopefully provocative. Please use discernment! Use logical thinking, your own intuition and your own connection with Source, Spirit and Natural Laws to help you determine what is true and what is not. By sharing information and seeding dialogue, it is our goal to raise consciousness and awareness of higher truths to free us from enslavement of the matrix in this material realm.

EN

EN FR

FR

People spend on new lphone, lpad, madbook every year

This article doesn’t deal with reality. Main street never got out of the recession and we are OVER 10% inflation. Wall St. in rigged and not the real economy. Unemployment is 23% real figures, Main St. is in debt, corporations have the biggest debt ever, US debt is the highest in the world and our GDP is in the minus. Get REAL…