By Avie Scheneider,

U.S. stock indexes fell sharply Monday, a day after the Federal Reserve aggressively cut interest rates to near zero in a bid to stop the economy from crashing. The Dow Jones Industrial Average dropped 2,997 points, or about 13%, as coronavirus measures rapidly expanded. The S&P 500 index lost nearly 12%.

The Dow has lost 31.7% since its record high Feb. 12 as the market plunges deeper into bear territory after an 11-year winning streak.

The deep stock market sell-off reflects broad concerns that despite these economic measures, the U.S. economy is likely heading toward a recession.

Many parts of the economy have abruptly come to a standstill. On Monday afternoon, most of Bay Area shut down from a directive. San Mateo Mayor Joe Goethals said only police and fire departments, hospitals, grocery stores, pharmacies and a few other businesses will be allowed to remain open.

In the rest of the country, government orders temporarily closed restaurants and bars in New York City, Los Angeles and Chicago and recommendations to ban groups of more than 10 people have been among the latest attempts to stem the spread of the coronavirus.

The hard-hit airline industry is seeking $50 billion in aid and loans from the federal government. “The rapid spread of COVID-19, along with the government and business-imposed restrictions on air travel, are having a unprecedented and debilitating impact on U.S. airlines,” the industry group Airlines for America said.

In an afternoon news conference, President Trump said “we’re going to back the airlines, 100%.”

Leaders of the Group of Seven — the U.S., Canada, France, Germany, Italy, Japan and the United Kingdom — agreed to work together to speed up and coordinate the global response to the pandemic.

“We are mobilizing the full range of instruments, including monetary and fiscal measures, as well as targeted actions, to support immediately and as much as necessary the workers, companies, and sectors most affected,” the G-7 said in a statement.

Markets In Europe, Asia Plummet After Central Banks Slash Rates Amid Coronavirus

The S&P 500 index fell 12% after temporary trading halts were lifted on the New York Stock Exchange.

A 7% drop in the S&P 500 automatically forces trading to stop for 15 minutes, which has happened three times in the past week.

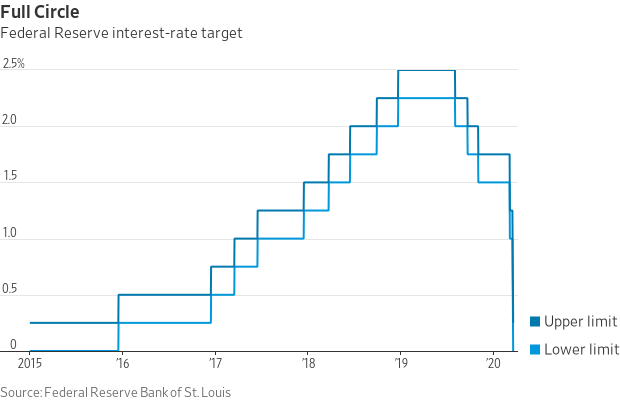

On Sunday evening, the Fed took the extraordinary move of cutting rates by 1 percentage point to near zero. The last time it moved rates that low was in 2008, during the financial crisis.

“The effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook,” the Fed said in a statement.

The drops on Wall Street follow steep falls in Europe, where stock indexes were down as much as 11% Monday.

Oil prices fell nearly 9% to about $29 per barrel. They’re down more than 50% so far this year.

In cutting its key interest rate to near zero, the Fed has not left itself much room to act on rates in the future. It has basically given up a major policy tool — one that it would need if the economy tumbled into recession.

The Fed also said it will buy $700 billion of Treasurys and other government securities to help grease the financial markets. It took similar steps, known as quantitative easing, during the financial crisis.

The Fed said it’s “prepared to use its full range of tools to support the flow of credit to households and businesses.”

Source: https://www.npr.org

Disclaimer: We at Prepare for Change (PFC) bring you information that is not offered by the mainstream news, and therefore may seem controversial. The opinions, views, statements, and/or information we present are not necessarily promoted, endorsed, espoused, or agreed to by Prepare for Change, its leadership Council, members, those who work with PFC, or those who read its content. However, they are hopefully provocative. Please use discernment! Use logical thinking, your own intuition and your own connection with Source, Spirit and Natural Laws to help you determine what is true and what is not. By sharing information and seeding dialogue, it is our goal to raise consciousness and awareness of higher truths to free us from enslavement of the matrix in this material realm.

EN

EN FR

FR

I totality agree with that statement congress SHOULD NOT bail out these greedy idiots running these corrupt corporations,enough,is enough, let them go bust and we will nationalize them, it’s the airlines own fault for doing what they did and line their (CEO’s) pocket at the expense of the flying public and rip off us tax payers by not paying their fair share.I can remember back in ’70’s you could fly from Seattle round trip to Montana and back for $100.00 with NO other fees and NO TSA,. I have not been on an Commercial aircraft since 2004 because of what the Fed.Gov. has done to the industry.The TSA is just a boogie man and NOT needed !!!!

RK

Let the War Machine, Prostitutes of Black Money Magic/Usury Federal Reserve Burn Down.